We are alternative energy leaders – as investors, developers, operators, and strategists.

Our History

AltEnergy, LLC (AE) was founded by Russell Stidolph in 2006 when he left the private equity firm, J.H. Whitney & Co. At Whitney, Russ led some of the U.S. market’s first large scale, successful, alternative energy transactions. While at Whitney he led transactions and co-founded companies such as Hawkeye Renewables which grew into the third largest ethanol producer in the US, and Iowa Winds, which had developed one of the largest wind power portfolios in Iowa at the time. Since its inception AE has been a founding or lead investor – and active corporate development or management partner — in several significant alternative energy projects and businesses including Tres Amigas, Viridity Energy, Eos Energy Storage, Broadview Energy, Iowa Winds, and Anbaric Energy.

Our Approach

Landmark Projects

We seek out and complete big important projects that others can’t or won’t do.

Advanced Technology

We look for proven ideas and technologies that will be relevant in the next three to five years.

Leading Business Solutions

We aim to build profitable companies distinguished by best in class operations and unique value propositions.

Roles

We are active investors and support portfolio assets with management, governance, industry relationships, and/or advice, as needed. We also serve outside organizations on a consulting basis.

Timing

AE seeks to anticipate major industry trends several years in advance and get involved at inflection points – the open window when a new technology or market is finally ready for commercial development but has not yet gained wide acceptance. AE’s ability to foresee trends and time these entry points is a significant competitive advantage, but we are also methodical investors employing a specific set of criteria.

Stage

Our answer to “build or buy” is — “both.” We have built successful companies from day one and we have led institutional investment rounds in developed businesses and ongoing projects. In the latter case we require a demonstrated product, market acceptance, and a clear path to cash flow within 2-3 years.

We aim to invest between $5-15 million in high growth companies.

Industry Access

For fifteen years the principals of AE have been developing successful partnerships with top firms and professionals in the energy sector. Our reach is broad. If we don’t know someone, we know someone who does. We are fortunate to work directly, or through our portfolio companies, with many of the leading firms in the industry.

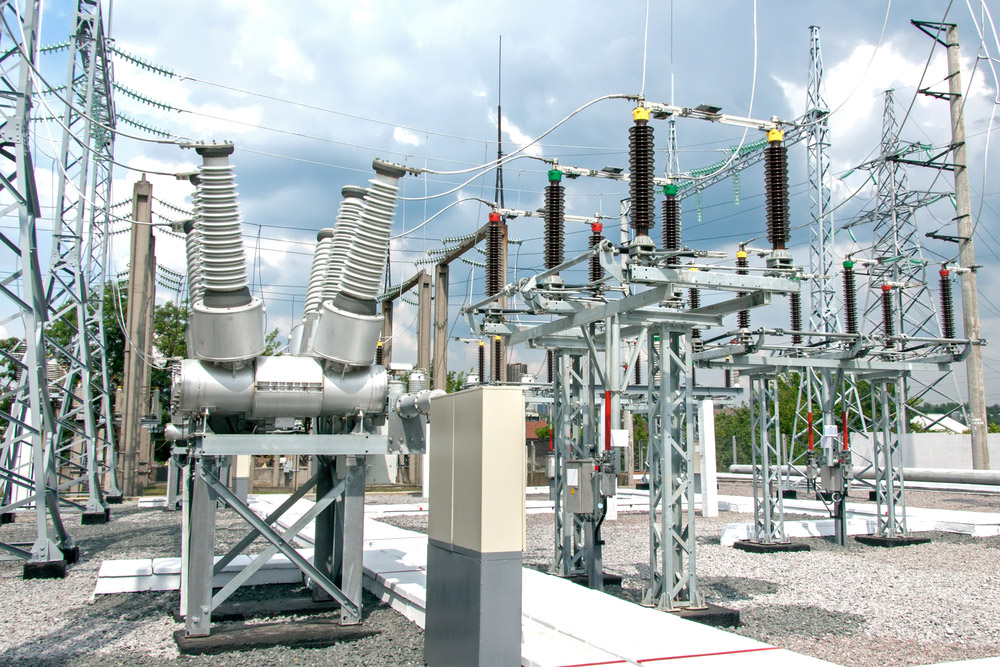

Utilities/Generators

We and our portfolio companies enjoy business relationships with many leading utilities and electric power producers with generation assets exceeding 150GW in the U.S. These organizations include some of the largest electric power distributors in the world, developers and owners of all kinds of renewables and transmission assets, and key partners in developing the Smart Grid of the future.

OEM/System Integrators

We have participated as investors or developers in projects supported by some of the world’s largest and most sophisticated companies providing electric power equipment, engineering services, construction management, and systems integration. These partners range of well-known giant global industrial firms to leading U.S. specialists in various aspects of electric power infrastructure development.

Professional

AE has longstanding relationships with legal advisors from top law firms who are world recognized subject matter experts in areas of energy and regulatory practice critical to our mission. We keep the counsel of attorneys who are not only experts in the relevant law but energy industry leaders. As a business, we are also supported by national accounting firms at the project and corporate level.

Engineering

Successful project execution depends on the right design, securing all required stakeholder and regulatory approvals, and managing vendor selection and work processes. Having a world class team of the right engineering and consulting firms is a great help, and AE benefits from relationships with some of the best firms in the industry. Our use of consultants sometimes begins before we have committed to a project, or even a technology, as in the case of our Eos investment, which we made only after engaging top university scientists and consultants to help us analyze the complex field of advanced battery chemistry.

Financial

We have benefitted greatly from the capital, transactional advice, and deep energy industry knowledge of our financial partners which include global leaders in investment banking, private equity, energy infrastructure investing, and technology venture capital. We have also been fortunate to receive capital and co-investment support from leading investors from the family office and insurance sectors.

Manufacturing

Innovation backed by great execution is a recipe for commercial success. With portfolio companies that rely on innovation in technology and market strategy, AE and our management teams have made a strategic priority of building partnerships with some of the world’s premier materials and manufacturing companies. These partners give us assurance we will remain at the forefront of relevant technologies enable us to deliver product on a global scale at low cost and the highest quality.

QUESTIONS ABOUT INDUSTRY ACCESS? PLEASE INQUIRE …

We are more than happy to discuss our network in detail with interested parties to provide a better understanding of our firm or as an initial step, when appropriate, toward making introductions on your behalf.

Current Activities

AE’s active investments and development projects offer attractive opportunities for investors, developers, C&I customers, utilities, foundations, governments, and other institutions seeking to profit from or advance energy transformation.

EOS Energy

Low cost energy storage is critical to enable an efficient grid powered by renewable energy. Navigant forecasts that utility-scale energy storage demand will hit 8.5GWh by 2023. Eos is well positioned to capitalize. Pioneering zinc-hybrid technology and ultra-simple design make Eos the low cost leader (at $160/Kwh, the lowest announced price in the market), environmentally friendly commodity components, and a strong network of utility customer and strategic technology partners.

Low cost energy storage is critical to enable an efficient grid powered by renewable energy. Navigant forecasts that utility-scale energy storage demand will hit 8.5GWh by 2023. Eos is well positioned to capitalize. Pioneering zinc-hybrid technology and ultra-simple design make Eos the low cost leader (at $160/Kwh, the lowest announced price in the market), environmentally friendly commodity components, and a strong network of utility customer and strategic technology partners.

Eos has assembled a very large order book, and was the only non-Lithium Ion battery technology selected in PG&E’s recent closely watched RFP process conducted pursuant to California’s groundbreaking 1.3GW storage mandate. Eos won 13MW (52MWh) out of 75MW awarded.

Large opportunities exist for development, financial and industry partners as Eos levers its low-cost advantage to drive project success in the booming energy storage market. Learn more at eosenergystorage.com …

Viridity Energy

Intelligently matching electric power supply and demand to maximize efficiency, manage renewables’ intermittency, and minimize total system generating requirements is the promise of the Smart Grid. Viridity delivers on this promise with an advanced SaaS platform turning commercial and industrial (C&I) customers’ load into virtual power for the grid. The company’s proprietary software, VPower, gives C&I customers a plug and play solution for monetizing demand and generation assets.

Intelligently matching electric power supply and demand to maximize efficiency, manage renewables’ intermittency, and minimize total system generating requirements is the promise of the Smart Grid. Viridity delivers on this promise with an advanced SaaS platform turning commercial and industrial (C&I) customers’ load into virtual power for the grid. The company’s proprietary software, VPower, gives C&I customers a plug and play solution for monetizing demand and generation assets.

VE’s capital light go-to-model leverages channel partners — including GDF Suez (world #1 utility) and Con Ed Solutions — to reach their C&I customers, freeing VE to focus on enhancing its cutting edge software and solutions platform. From real time wholesale energy market pricing and trading to the market’s leading battery storage integration capability, VE offers a comprehensive energy management platform for the large energy user.

VE has also pioneered electric rail energy storage and demand management, working with SEPTA to create the nation’s first profitable commercial regenerative braking /DR installation, now rolling out across nine Philadelphia area stations. The company is also leading landmark development work on grid-scale commercial building energy storage.

Attractive opportunities exist for business, project and investment partners to collaborate with VE to profit from creating the Smart Grid of the future – today. Learn more at viridityenergy.com …

Tres Amigas

With enormous solar potential in the Southwest and massive wind resource up and down the Midwestern United States, America needs a unified grid system that can move power around the country from where it’s produced to where it’s needed. Unfortunately, the U.S. grid “system” is comprised of three asynchronous “island grids” that aren’t connected – the Eastern, Western, and ERCOT Interconnects. That’s where Tres Amigas comes in. This landmark project will unite these grids for the first time. And the first leg of the project is now underway, allowing 497MW of new wind power to flow Texas and New Mexico to California.

With enormous solar potential in the Southwest and massive wind resource up and down the Midwestern United States, America needs a unified grid system that can move power around the country from where it’s produced to where it’s needed. Unfortunately, the U.S. grid “system” is comprised of three asynchronous “island grids” that aren’t connected – the Eastern, Western, and ERCOT Interconnects. That’s where Tres Amigas comes in. This landmark project will unite these grids for the first time. And the first leg of the project is now underway, allowing 497MW of new wind power to flow Texas and New Mexico to California.

Tres Amigas offers wind and solar developers an attractive new option for developing otherwise stranded renewable resources. Learn more at tresamigasllc.com …

Renewables Generation

AE has been developing and financing the development of renewable power projects successfully for 15 years. Whether you are an institutional investors looking for exposure to attractive uncorrelated long-term yield, or an early stage developer with an attractive but challenging project needing capital and expertise for completion, we can help.

AE has been developing and financing the development of renewable power projects successfully for 15 years. Whether you are an institutional investors looking for exposure to attractive uncorrelated long-term yield, or an early stage developer with an attractive but challenging project needing capital and expertise for completion, we can help.

New Areas of Interest

Reactive Power: A critical grid service we expect to become a $5bn/year industry currently with no dedicated developers. AE is building a platform with OEMs and asset owners to tap into this opportunity.

HVDC: Through Tres Amigas and our investment in Anbaric Transmission, AE has world class expertise in this large and rpidly growing global industry. We are actively looking at projects in Europe and open to new opportunities.

Senior Management

Russell Stidolph

Managing Director

Mr. Stidolph is the founder and a Managing Director of AltEnergy, a private equity firm focused on alternative energy investing. Prior to founding AltEnergy, Mr. Stidolph was a Principal at J.H. Whitney & Co. a middle-market private equity firm based in New Canaan, Connecticut. While at J.H. Whitney Mr. Stidolph was responsible for starting and developing the firm’s alternative energy investing practice. Notably, Mr. Stidolph led the firm’s investment in Hawkeye Renewables, which he grew into the third largest ethanol producer in the U.S. before being sold in 2006 At Hawkeye, Mr.Stidolph served as both the CFO and the Vice-Chairman of the Board. Prior to Hawkeye, he co-founded and led Whitney’s investment in Iowa Winds, LLC which built a 300+ MW portfolio of wind assets, later sold to large U.S. utility. Prior to joining J.H. Whitney, Mr. Stidolph was a member of the corporate finance group at PaineWebber responsible for high yield and leverage finance origination.

Read more ...

Mr. Stidolph brings significant investing, start-up, and large scale development experience to AltEnergy ventures. A number have been landmark projects or innovative companies in their fields. Eos Energy Storage is a leading advanced battery company with the lowest announced cost and largest order book in the booming grid-scale storage industry. Tres Amigas, co-founded by Mr. Stidolph, is a $1.6bn project to unite via HVDC interconnect the three major U.S. regional power grids, the Western, Eastern and ERCOT/Texas Interconnects, all currently “islanded.” Funding for the first leg has been arranged with substantial capacity sold under a long term offtake agreement. Mr. Stidolph continues to guide the venture as CFO and board member.

AltEnergy was the founding investor of Viridity Energy, Inc., a leading smart-grid services company. Today Viridity offers an industry-leading Smart Grid solution for commercial/industrial customers, the only SaaS platform with a patented decision engine and integrated solar/storage capability, and go-to-market strategy based on customer/channel partners including ConEd Solutions and GDF Suez (the world’s largest utility.)

Mr. Stidolph serves on the Board of Directors of Tres Amigas, Viridity, American Heartland Development, AgriSol Energy, and Eos . Mr. Stidolph received a Bachelor of Arts degree from Dartmouth College.

Arul Gupta

Managing Director

Mr. Gupta is a Managing Director of AltEnergy, LLC and brings to bear significant project development, capital raising and international investment experience. Mr. Gupta is actively involved in all aspects of the investment process from sourcing, structuring, executing, monitoring & developing and exiting transactions. Serving as AltEnergy Board Observer to Eos Energy Storage, Viridity Energy, Tres Amigas and AgriSol Energy, Mr. Gupta plays an active role in supporting portfolio company management.

Previously, Mr. Gupta was a banker with Imperial Capital where he advised middle-market clients on restructuring, special situations, liability management, capital raising and mergers & acquisitions across a wide range of industries. Select transactions include raising $250 million in founding equity from a leading middle market private equity firm for a large aftermarket aircraft parts supplier; and advising clients on over $1.5 billion of restructurings in the technology, materials and consumer sectors.

Read more ...

Mr. Gupta received a Bachelor of Science in Operations Research & Industrial Engineering from Cornell University.

Jon Darnell

Managing Director

Mr. Darnell is a Managing Director of AltEnergy LLC and brings over 30 years of experience with the U.S. alternative energy sector spanning the public policy and commercial arenas. Prior to joining AltEnergy, Mr. Darnell founded and served as President of Patolan Partners, an alternative energy and investments boutique. Since launching Patolan at the end of 2011, Mr. Darnell has sourced attractive opportunities yielding capital commitments over $450MM across a wide range of projects and investments – from utility scale solar and wind developments with D.E. Shaw Renewable Investments (DESRI) LLC to middle market credit to growth capital for leading energy technology firm Eos Energy Storage.

Read more ...

Prior to Morgan Stanley, Mr. Darnell served for 18 years in senior management and as a board member with the largest multi-issue public interest advocacy group in the United States, The Public Interest Network, and worked in social entrepreneurship. In this time he played a number of roles including chief executive of Telefund, Inc., an environmental/public interest-oriented communications firm, which he led from early stage through ten years of 45% compound profit growth, building a client base of the nation’s most important environmental and public interest advocacy groups, and the major national Democratic Party organizations. Mr. Darnell also served as founding chairman of Citizens for Safe Energy, the national advocacy group for renewable and safe energy policies that developed into the energy program of the U.S. Public Interest Research Group (PIRG).

Mr. Darnell maintains his civic involvement, serving as a Trustee of Green Century Funds, the first environmentally screened mutual fund in the U.S. (and first carbon-free fund family), and board member of Voices for Progress, a grasstops lobby that meets regularly with members of the U.S. Senate on environmental and public interest concerns.

Mr. Darnell graduated magna cum laude with an AB in philosophy from Princeton University and earned his MBA in finance from the Wharton School of the University of Pennsylvania. He is a competitive, former nationally ranked squash player (#12 U.S. Men’s 35-39) and accomplished musician, having trained for eight years in the Pre-College Division of The Juilliard School.

ENGIE Purchases Northern Power Integrated 1MW Eos Aurora® Battery for Landmark Solar and Wind Project in Brazil

NEW YORK–(BUSINESS WIRE)–ENGIE, Eos Energy Storage (“Eos”) and Northern Power Systems Corp. (TSX: NPS) today announced that the they will work together to install a 1 megawatt (MW), 4 megawatt-hour (MWh) grid-scale energy storage solution supporting a hybrid solar and wind demonstration project, developed by ENGIE in Brazil. Eos and Northern Power will together manufacture and supply the turn-key, fully-integrated energy storage system combining the Eos Aurora battery with Northern Power’s FlexPhase™ power conversion technology and intelligent controls.

“In order to further develop the penetration of wind and solar, that are both intermittent sources of energy, and provide them as a stable green base load product to our clients, we need storage. We are therefore exploring many options available in the market. The integrated battery system from Eos and Northern represents a combination of a new promising Zinc based energy storage solution and a new digital based piloting system, which are attractive both from a cost and performance perspective,” says Raphael Schoentgen Research & Technology Director at ENGIE.

Ormat Technologies Announces Closing of the Acquisition of Viridity Energy

RENO, Nev., March 15, 2017 (GLOBE NEWSWIRE) — Ormat Technologies, Inc. (“Ormat”) (NYSE:ORA) today announced that it has closed its previously announced acquisition of substantially all of the business and assets of Viridity Energy, Inc. (VEI).

VEI is a privately held Philadelphia-based company with nearly a decade of expertise and leadership in demand response, energy management and storage. Using proprietary software and solutions, VEI serves primarily retail energy providers, utilities, and large industrial and commercial clients.

Western Interconnect Announces Open Season for Transmission Service Rights on the Western Interconnect Project

SAN FRANCISCO, CA–(Marketwired – Oct 17, 2016) – Western Interconnect LLC (“WI”) launched on October 3, 2016, an Open Season process to allocate up to 603 MW of transmission rights on its proposed transmission line in New Mexico. Through this Open Season, WI will solicit Transmission Service Requests (“TSR”) from parties willing to acquire firm transmission service rights at the same rates, terms and conditions as offered to anchor customers on the line. The TSR submission window will conclude on November 11, 2016. Interested parties can access the WI Open Season website (www.WesternInterconnect-os.com), which contains additional information about the project and the Open Season process.

Connecticut Office

137 Rowayton Avenue

Rowayton, CT 06853

Phone: (203) 299-1400

Fax: (866) 856-4916

info@altenergyllc.com

New York City Office

1350 Avenue of the Americas, 2nd Floor

New York, NY 10019

Phone: (646) 450-8045

Fax: (212) 257-6441

info@altenergyllc.com

American Heartland wind has completed early stage development of 500-1000MW of wind power in the Midwest, and expects to sell these assets in the near future.

American Heartland wind has completed early stage development of 500-1000MW of wind power in the Midwest, and expects to sell these assets in the near future. Anbaric is a transmission project development company located near Boston, MA that specializes in early stage development of large-scale electric transmission systems (especially controllable DC lines) and small, medium and large scale micro grid projects.

Anbaric is a transmission project development company located near Boston, MA that specializes in early stage development of large-scale electric transmission systems (especially controllable DC lines) and small, medium and large scale micro grid projects. Broadview is U.S. based wind project developer. AE was an investor in Broadview’s development of over 500MW of wind assets in New Mexico, recently sold to a major public asset owner. Power from the projects will be transmitted to market through the first leg of the Tres Amigas Interconnect.

Broadview is U.S. based wind project developer. AE was an investor in Broadview’s development of over 500MW of wind assets in New Mexico, recently sold to a major public asset owner. Power from the projects will be transmitted to market through the first leg of the Tres Amigas Interconnect. AE was the lead investor in Eos Energy Storage’s Series C round, backed by major institutional strategic investors; Eos has the lowest announced cost in the industry and very large project pipeline in the rapidly growing electricity storage market.

AE was the lead investor in Eos Energy Storage’s Series C round, backed by major institutional strategic investors; Eos has the lowest announced cost in the industry and very large project pipeline in the rapidly growing electricity storage market. AE founder Russ Stidolph co-founded Hawkeye Renewables while at JH Whitney. He led the sale of the company to private equity in 2006 while serving as the company’s CFO and Vice-Chairman of the Board.

AE founder Russ Stidolph co-founded Hawkeye Renewables while at JH Whitney. He led the sale of the company to private equity in 2006 while serving as the company’s CFO and Vice-Chairman of the Board. Through its wind power development company Iowa Winds, AltEnergy developed a 300MW project portfolio and sold it to a public utility company.

Through its wind power development company Iowa Winds, AltEnergy developed a 300MW project portfolio and sold it to a public utility company. Russ Stidolph was a co-founder and AE was an early investor in Tres Amigas, the HVDC super-hub that is uniting the three major, currently “islanded”, power grids in the U.S. Funding for the first leg has been arranged with substantial transmission capacity being sold under a long term offtake agreement

Russ Stidolph was a co-founder and AE was an early investor in Tres Amigas, the HVDC super-hub that is uniting the three major, currently “islanded”, power grids in the U.S. Funding for the first leg has been arranged with substantial transmission capacity being sold under a long term offtake agreement AE is the founding investor in Viridity Energy, Inc., a leading smart-grid services company. Viridity offers an industry-leading Smart Grid solution for commercial/industrial customers, the only SaaS platform with a patented decision engine and integrated solar/storage capability, and go-to-market strategy based on customer/channel partners including ConEd Solutions and GDF Suez (the world’s largest utility.)

AE is the founding investor in Viridity Energy, Inc., a leading smart-grid services company. Viridity offers an industry-leading Smart Grid solution for commercial/industrial customers, the only SaaS platform with a patented decision engine and integrated solar/storage capability, and go-to-market strategy based on customer/channel partners including ConEd Solutions and GDF Suez (the world’s largest utility.)